-

What Do Lasagna and Estate Planning Have in Common?

Most people think “estate planning” is the same as drafting a will or trust. This is a common misconception. Estate planning isn’t about certain documents but more like a good lasagna recipe.

-

3 Questions to Ask Yourself Before Creating Your Estate Plan With AI

The allure of Do-It-Yourself estate planning through AI is substantial, especially when you think your situation is simple. But here’s the truth: estate planning is not just about creating a set of documents, and it’s almost always more complicated than you think.

-

Reflections on Your Legacy

This fall, we invite you to take a meaningful pause and reflect on the legacy you’re building through your life’s work. Your hard work deserves to be protected. You can ensure that everything you’ve built is passed on exactly as you wish, safeguarding your values and assets for future generations. It’s a call to action…

-

How Relying On Beneficiary Designations Puts Your Family at Risk (And How To Fix It!)

As a professional in the field, I’ve seen many financial advisors, accountants, and even other lawyers suggest that naming beneficiaries on your accounts is sufficient, and that you don’t need an estate plan. However, they often overlook the potential risks to your family’s financial future.

-

Would $23,000 Make a Difference to You?

Imagine discovering thousands of dollars that belong to you, only to be told you can’t have it. It’s called “unclaimed property,” money that’s yours but has been handed over to the government without your knowledge. And it happens more often than you may think.

-

Would You Make This Million Dollar Mistake?

Imagine this: You’re in your twenties, and you fill out a form at work naming your significant other as the beneficiary of your retirement account. Fast-forward 28 years—you’ve long since broken up, lived a full life, and died, and your ex gets your now-million-dollar nest egg. Sound far-fetched? It’s not.

-

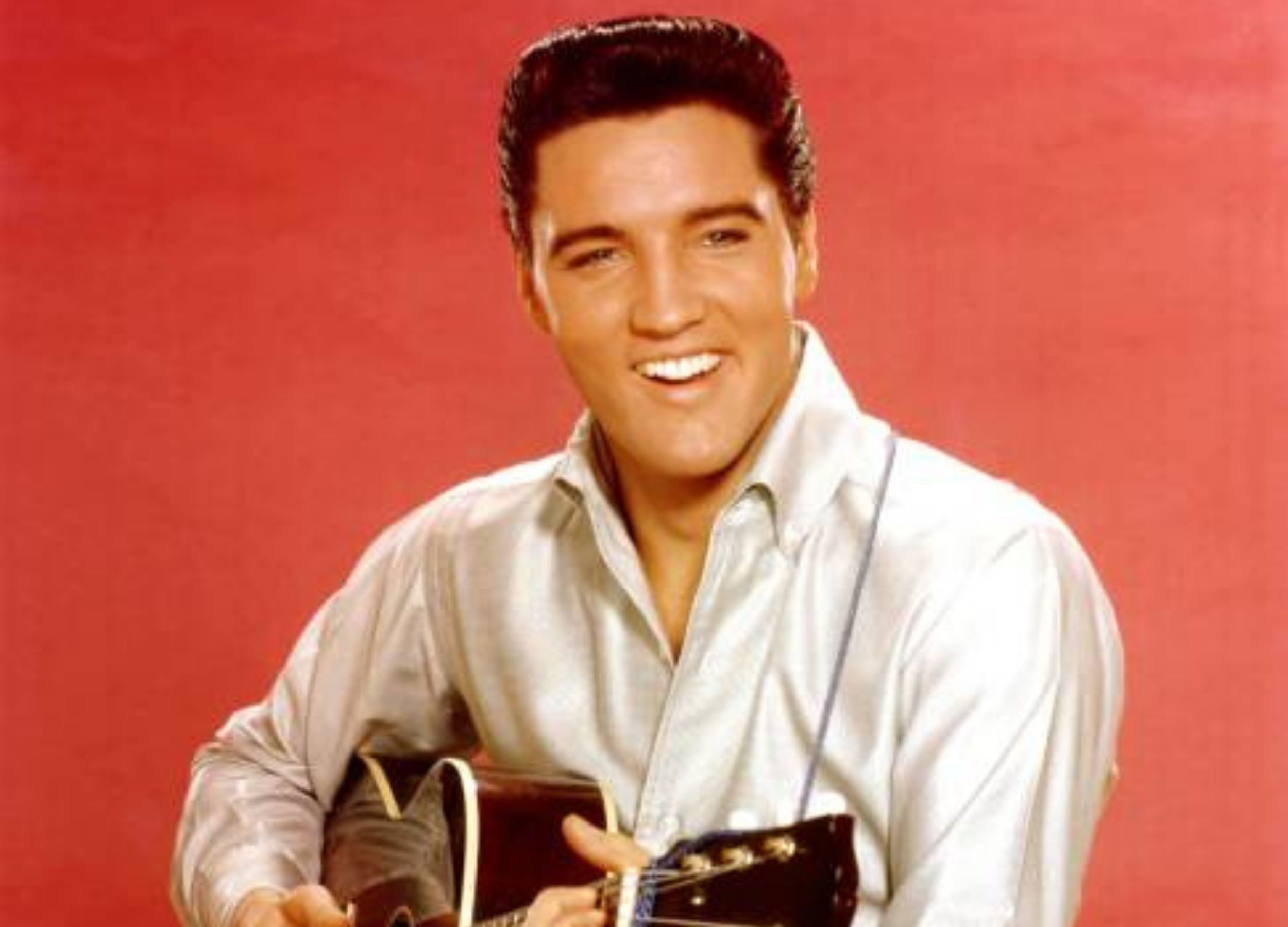

Celebrity Estate Plans Series Part 4 of 4: Elvis and the Scammers

In this last installment of our four-part celebrity series, we spotlight Elvis, the King of Rock. Although he passed away in 1977, his estate can teach us valuable lessons, even in 2024, about the importance of estate planning and how to avoid falling prey to scammers.

-

Celebrity Estate Plans Series Part 3 of 4: Jay Leno’s Case is No Laughing Matter

In this third installment of our four-part celebrity series, we discuss a topic that no one wants to consider as it may seem to be a fate worse than death: incapacity. Find out what Jay Leno and his family can teach us about the need to be prepared, no matter what happens.

-

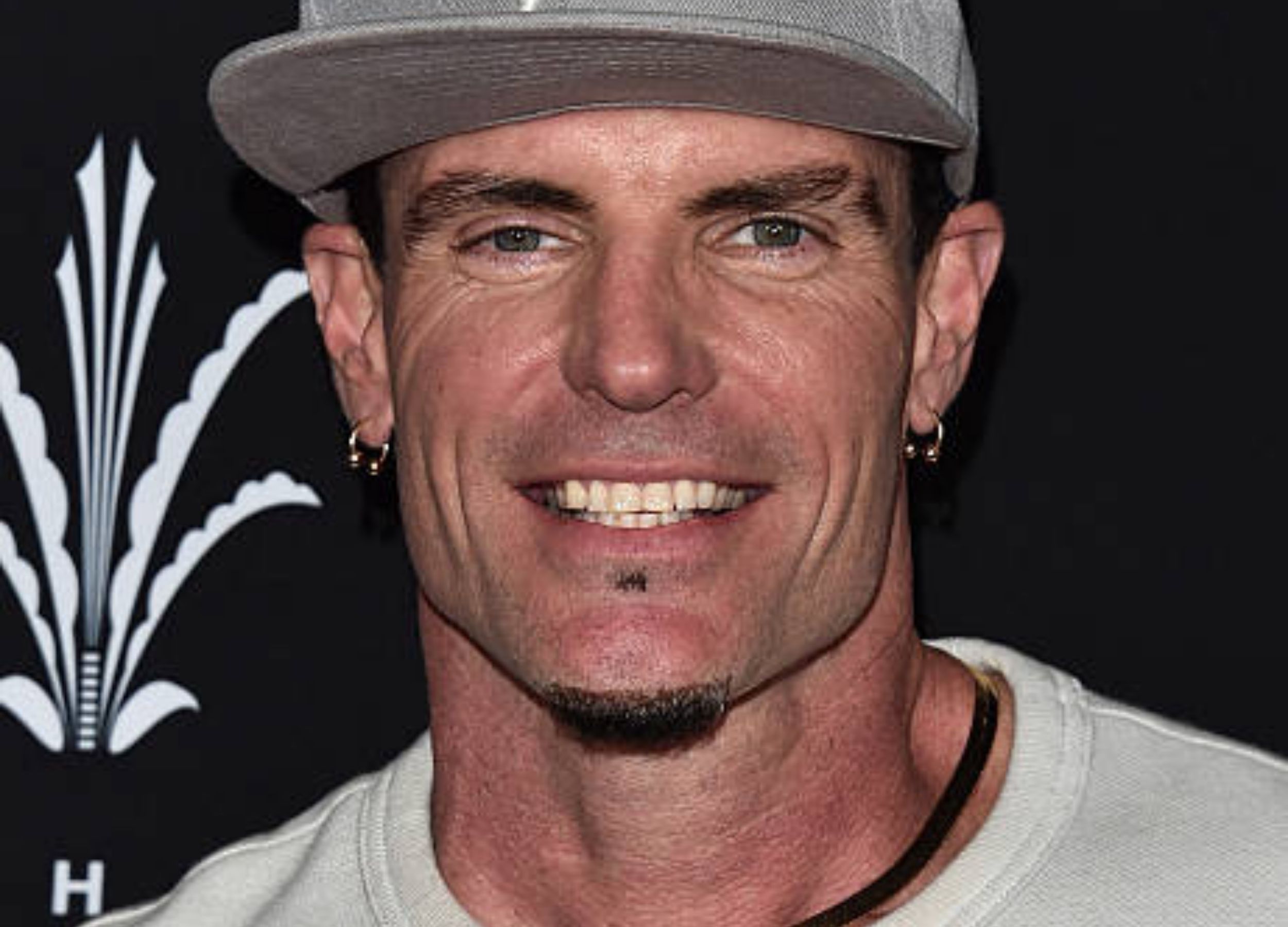

Celebrity Estate Plans Series Part 2 of 4: Vanilla Ice Has Thoughts

This week, we’re continuing to look at the lives of 4 celebrities and how they’re preparing for the inevitable (or didn’t!). Last week, we examined Michael Jackson’s planning and the holes in his plan that resulted in his family being embroiled in court and conflict for 15 years and counting (if you missed it, go…

-

Celebrity Estate Plans Series Part 1 of 4: Michael Jackson

What is it about celebrities that always draws us in? For whatever reason, we just can’t resist a good, juicy celebrity story. So, for the next few weeks, we will look at the lives of 4 celebrities and see what we can learn from their stories. This week, we’re turning the spotlight on Michael Jackson.…

-

The Surprising Connection Between Men’s Health and Estate Planning

As you may know, June marked Men’s Health Month, a time dedicated to raising awareness about health issues predominantly affecting men and encouraging the early detection and treatment of disease among men and boys. Gentlemen, you already know that taking care of your health allows you to prolong your life and enhance your quality of…

-

3 Strategies For Navigating Your Child’s Transition Into Adulthood

When your child turns 18, they’re legally an adult even though they have a lot more growing to do. Just like any other adult, their health and financial information is protected by privacy laws. But unlike any other adult, that’s still your child, and you want to support them in a crisis. Your role as…